tax on forex trading in canada

Usually this means that 50 of the profit is taxed and the other 50 is not however this is subject to change as with any tax laws. How to make money by trading in india.

Forex Trading In Canada Is It Legal Do I Pay Taxes

Corporation Tax tax you pay on your limited company earnings.

. You are not required to have any special software to trade. Capital gains taxable at 50 at your home tax rate apply to day trading income as there is no capital gain tax in Canada. The profits and losses of day trading must be.

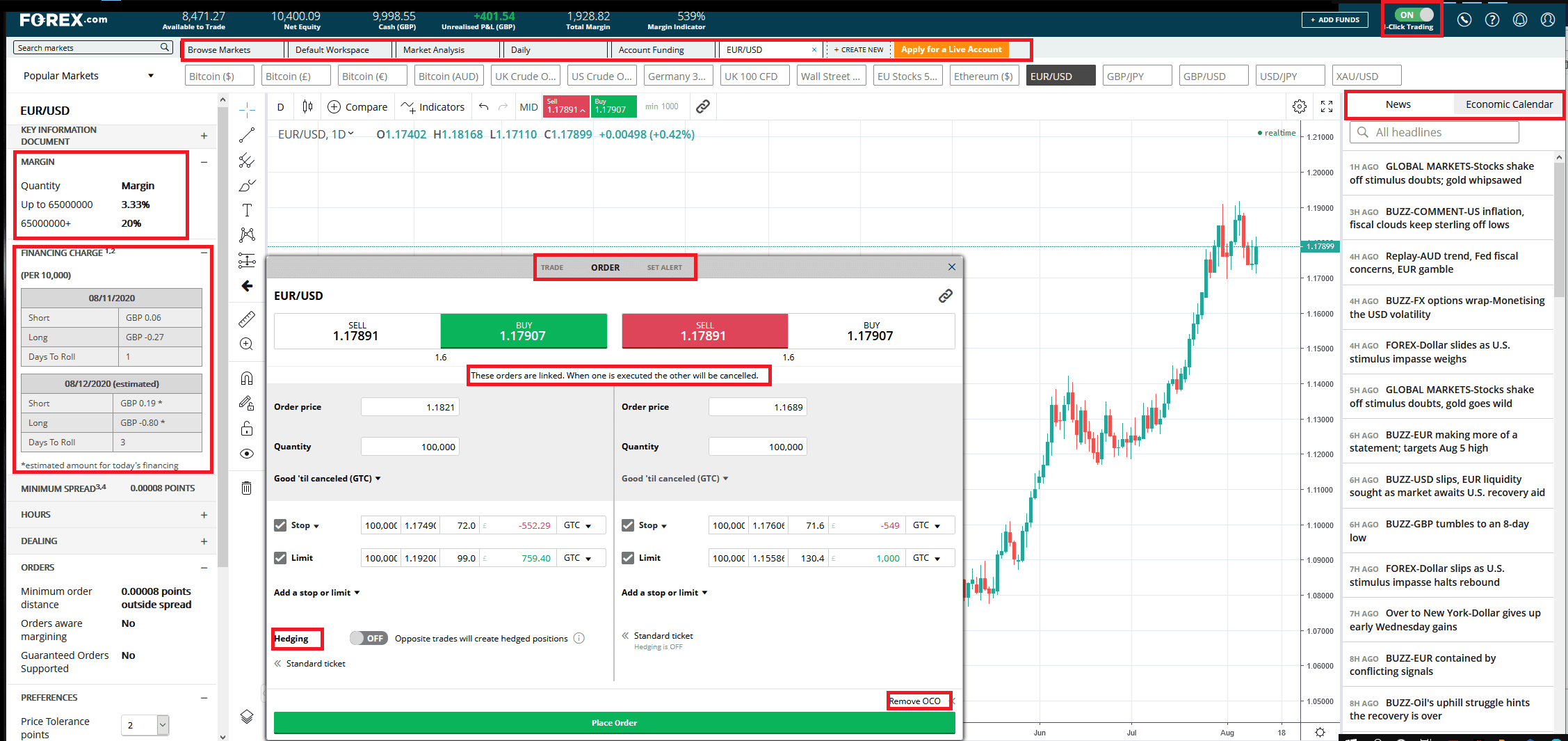

See The Daily Results. You can open an account and start trading forex via desktop or mobile within minutes by sending funds to. If youre an investor infrequent trades with long-term investing horizon youll treat any profits as a capital gain.

Find an online forex broker that accepts clients from Canada. However you only have to report the amount of your net gain or loss for the year that is more than 200. Open a margin account with that broker.

On top of that trading fees are not tax deductible. After doing so multiply the difference by the tax rate on the gain that has been earmarked for the trader. Taking stock market trading courses to educational resources purchasing a computer monthly internet bill etc.

Trading is done on a small number of instruments repeatedly on a short time scale thus triggering on income account for securities. Discussion in Taxes and Accounting started by ArcticTrader Jun 7 2006. This means 50 of your gains are taxed at your marginal tax rate.

Tax reporting on forex trading in Canada is straightforward. Forex tax in Canada is treated as an ordinary business and tax is paid as a business income tax. Taxes and trading in Canada - question.

Foreign exchange gains or losses from capital transactions of foreign currencies that is money are considered to be capital gains or losses. Is Trading Tax Free In Canada. Ad Trade Forex 23 Hours a Day Sunday through Friday.

IT95R suggests forex is at the discretion of the filer. 1 2 3 Next ArcticTrader Guest. Income Tax tax you pay on your overall earnings.

When trading futures or options investors are effectively taxed at the maximum long-term capital gains rate or 20 on 60 of the gains or losses and the maximum short-term capital gains rate. With some assets its pretty clear-cut as to whether they will be treated as income or capital gains. It means that 60 of your gains or losses will be counted as long-term capital gains or losses while the remaining 40 will be counted as short-term gains or losses.

However you will pay 100 for capital gains. This tax rate is 25 for federal taxes and then provincal taxes should be included for some provinces. However the 2010 CRA Income Tax Interpretation Bulletin makes it clear that forex trading taxes in.

Futures and FX Trading AudaCity Capital Forex Trader Funding AXIA Futures Trader Training and Mentorship Bookmap Visual Trading Platform. Foreign exchange gains or losses from capital transactions of foreign currencies the gain has to result from a capital transaction to be reported as a capital gain. A capital loss can only be used to reduce or eliminate capital gains.

Any income or salary earned is subject to capital gains tax and forex traders should be prepared to pay up to 50 on profits. As a result you can deduct a day trading income resulting in only a 50 taxation at your personal tax rate. Forex options and futures contracts are considered IRC Section 1256 contracts for tax purposes.

Canadian tax laws on currency trading are another topic of interest. Its saying that IF it is a gain or loss it is only reportable if its over 200. Forex trading in Canada is regulated but most Forex brokers cannot consider the Canadian regulatory environment as favorable which explains why the country is not home to a high number of domestic brokers.

As such they are subject to a 6040 tax consideration. If its business income then there is no threshold. By trading volume the foreign exchange market also known as Forex or FX is the largest trading market in the world seeing millions of transactions every day totalling upwards of 6 billion US dollars.

Is it the same for forex and commodities. Unlike most countries where Forex profits are treated and taxed as income in Canada it is subject to Capital Gains tax. To make the annual tax filing process stress-free keep a track of trades profits and losses throughout the year.

Deposit funds using a payment method the broker accepts. Is forex trading tax free in canada the beginners guide to forex derivatives markets. Trading forex in Canada is therefore lucrative and profitable from investments and points.

Most of the major players in the marketplace are international banks and financial institutions but there are also. Ad Three Powerful Forex Robots Finding Real Pips This Month For Users. Easy To Use - No Experience Required - 5 Minute Install - Lifetime Support.

Capital Gains Tax tax that you pay on your profits from selling assets. There are four types of tax that are relevant to forex traders. Provincial tax rates vary from 10 to 16.

In the current time we have started to accept cryptocurrencies like bitcoin litecoin and others as the money that you can use to buy your online things. Forex Trading in Canada. When it comes to regulation a fine line must be walked in order to ensure a fair market protect traders and allow innovation.

IT346R from 1970s for commodities suggests should be categorized as speculator capital gains. The losses from day trading are tax deductible against your employment income as well as some expenses linked to your business. If the net amount is 200 or less there is no capital gain or loss and you.

Stamp Duty Reserve Tax a tax or duty that you pay when you buy shares. Forex traders can deduct tax if they report.

Top 6 Countries For A Forex Trader Easy Trade

Is Forex Trading Tax Free In Canada Ictsd Org

Forex Trading Canada An Overview By Experts Wheon

![]()

The Best Forex Trading Canada Forex Ca Reviewed Forex Brokers In Ca

Solutions For Smart Traders And Investors Who Want To Pay Less Taxes

Do Forex Traders Pay Tax In Canada If Yes Then How Much Quora

How To Start Forex Trading In Canada Unugtp

Do You Pay Taxes On Forex Profits In Canada Ictsd Org

Is Forex Trading Legal In Canada Toshi Times

Forex Trading Academy Best Educational Provider Axiory Global

Forex Trading In Canada Is It Legal Do I Pay Taxes

Is Forex Trading Tax Free In Canada Ictsd Org

Forex Trading In Canada Is It Legal Do I Pay Taxes

A Guide On Forex Time Canada Forex Canada

What Is A Tax Ratio For Forex Trader In Canada Ictsd Org

A Guide On Forex Time Canada Forex Canada

Forex Trading Tax Canada How Are Trading Profits Taxed

Forex Day Trading Taxes Investment Canadians Must Watch Youtube